SAN ANGELO, TX — The Tom Green County Commissioners’ Court has proposed a tax rate that will generate significant new revenue for the county this year. The proposed rate is 0.47290 cents per $100 of property valuation. For the fiscal year 2025, which begins on October 1, the county anticipates approximately $10.5 billion in taxable property, up from $10.06 billion budgeted last year. The total amount property owners will pay is calculated by multiplying the tax rate by the taxable value of their property.

Although the rate remains unchanged from last year, it is 2.61 cents higher than the No-New-Revenue Rate. Last year's difference was 1.8 cents.

County Tax Rates at a Glance

| Item | FY 2023 | FY 2024 | FY 2025 |

|---|---|---|---|

| Property Tax Rate | $.50579 | $.47290 | $.47290* |

| No New Revenue Tax Rate | $.46887 | $.45504 | $.44685 |

| Voter Approval Tax Rate | $.51043 | $.48116 | $.49415 |

*Voted and proposed rate, not yet adopted until final vote on Aug. 27, 2024.

The court will hold a public hearing on the proposed rate on August 22 at 6 p.m. in the commissioners’ courtroom. The vote to adopt the new tax rate is scheduled for the regular meeting of the commissioners’ court on August 27. The rate will not be official until it is approved during the August 27 vote.

Commissioner Shawn Nanny (Precinct 4) made the motion to adopt the proposed tax rate, and Commissioner Sammy Farmer (Precinct 2) seconded. All five members of the court voted in favor of the proposed rate.

This year’s budget faced several challenges. First, due to a change in Texas state law, the $227 million Ethicon plant was removed from the property tax rolls, impacting the budgets of the City of San Angelo and the San Angelo Independent School District as well. Second, Judge Carter explained that the county's budget had faced a deficit for the past two years, which he was able to eliminate by maintaining the current tax rate and buying down state retirement costs for FY 2025. This was achieved by fronting a $1 million payment to the retirement system, which reduced the percentage the county pays monthly for all county employees’ retirement funds by about half a percent. Additionally, Sheriff Nick Hanna’s deputies and the Tom Green County Detention Center received considerable attention in the budget.

The FY 2025 budget will include a 5% cost-of-living pay raise for all county employees, a 3% wage increase for critical positions, and the capability to offer 1% merit raises. These pay raises are in line with the proposed increases for City of San Angelo employees for FY 2025.

Despite the rate remaining the same, taxpayers should be aware that rising property valuations with no counter reduction in the tax rate created effectively a tax increase. However, they can also recognize that the county is providing more value by offering better pay for employees, funding law enforcement, and addressing the removal of Ethicon from the tax rolls.

For more details on the FY 2025 Tom Green County budget, click here.

---

Correction: The tax hearing is at 6 p.m. on Aug. 22 not 8:30 a.m. as originally reported. The text of this story is corrected to reflect the correct time.

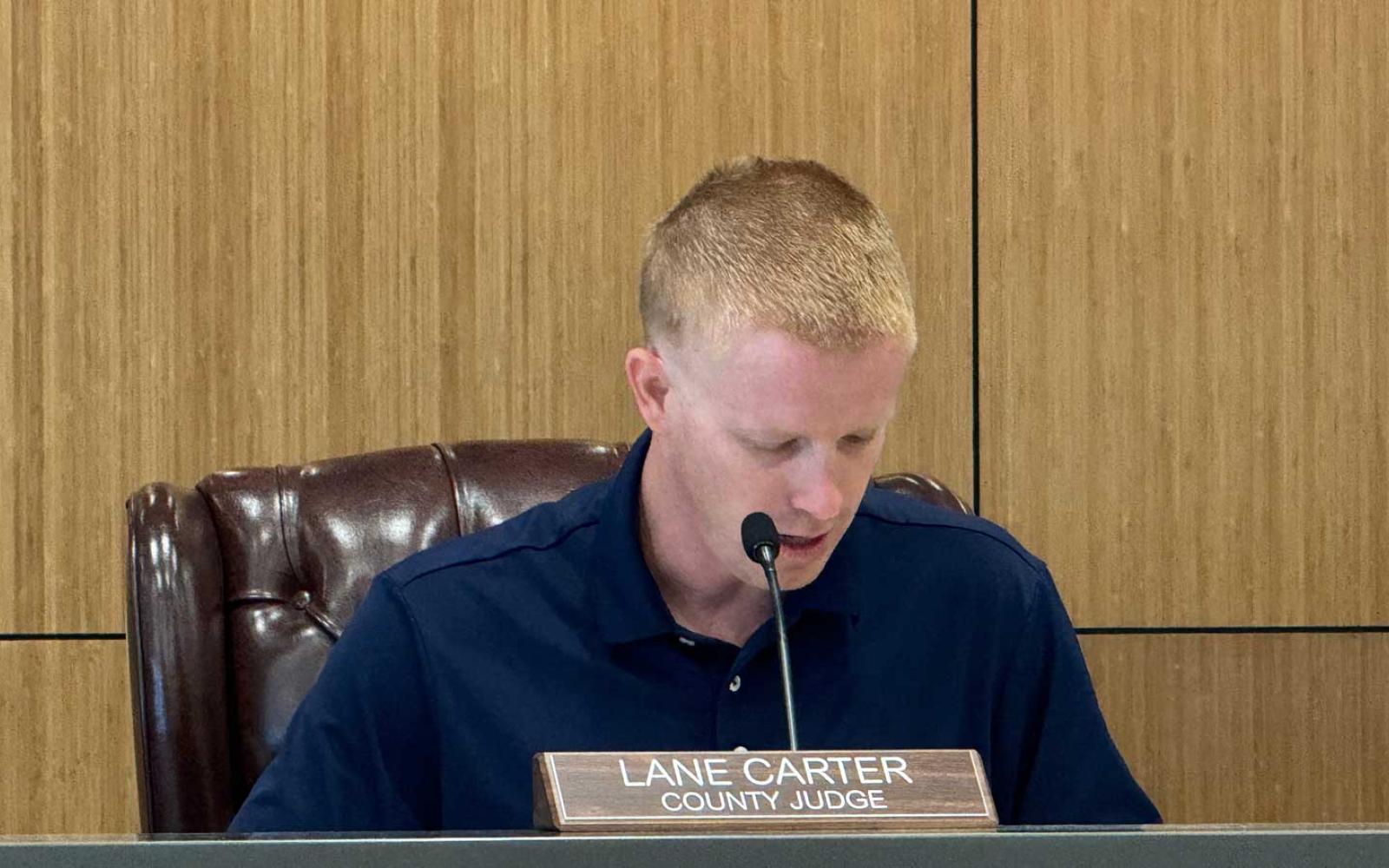

Tom Green County Judge Lane Carter proposes a tax hike at the Aug. 13, 2024 meeting of the county commissioners' court.

Subscribe to the LIVE! Daily

Required

Comments

Listed By: G.L. Mann

Please explain why Ethicon was removed from the tax rolls.

- Log in or register to post comments

PermalinkProbably the same reason Mayor Gunters home and property in Santa Rita didn't receive a property tax increase like everyone else. Just a guess

- Log in or register to post comments

PermalinkI think they went from $400k a year to $4.3 million. I may be wrong, but when the new appraiser director went up ten fold on Ethicon, it was cheaper for Johnson and Johnson to pay some senators to have them exempt from paying property taxes at all. I guess it backfired on Tyler Johnson. We need to get these people out of office. Our mayor and city manager too!

- Log in or register to post comments

PermalinkListed By: Captain Obvious

- Log in or register to post comments

PermalinkPost a comment to this article here: