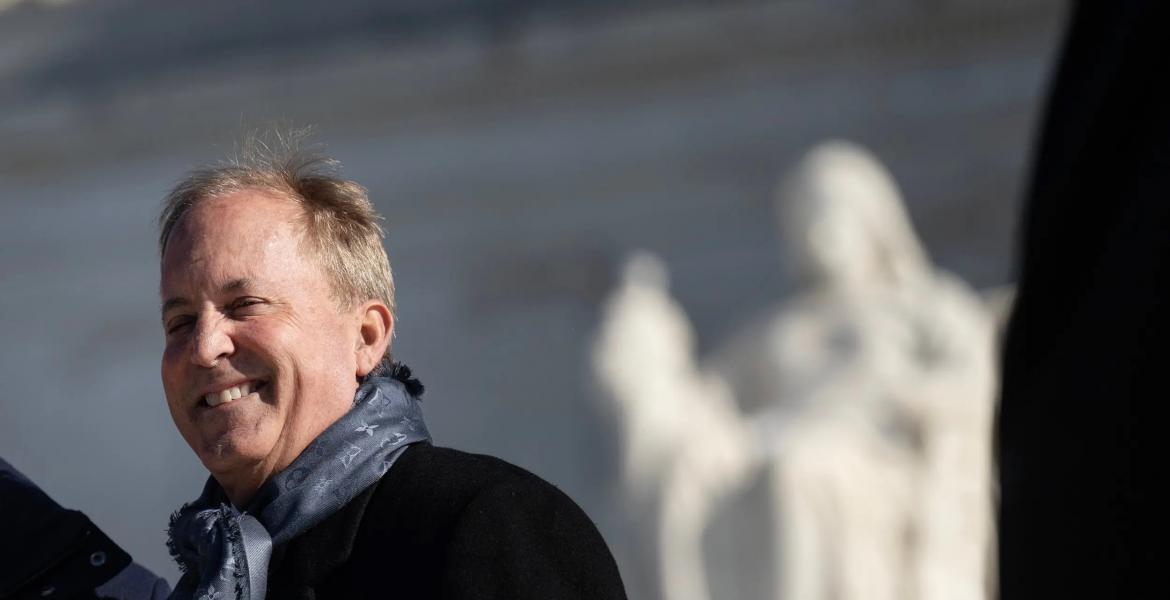

AUSTIN - Governor Greg Abbott Tuesday responded to a letter from members of the Texas Democratic Congressional Delegation regarding tax burdens on Texans. In his letter, the Governor voices his support of lessening the tax burden on Texans but clarifies that local governments—not the State of Texas—set the property tax rates. The Governor disagreed with the members' support of raising taxes in times of economic prosperity.

"Property owners shouldn’t be saddled with rising property taxes while dealing with a pandemic," said Governor Abbott. "As a result, local governments, who set property tax rates, should find ways to reduce the tax burden on Texans. Whether we're facing times of challenge or times of prosperity—raising taxes on the people of Texas is never the answer."

In his letter, the Governor also urged the members to help pass legislation that protects business owners, healthcare facilities and employees, and first responders from being held liable for COVID-19 exposure claims when they adhere to relevant public health guidelines and make good faith efforts to limit the risk of exposure and infection.

Subscribe to the LIVE! Daily

Required

Comments

Listed By: Old Salt

Any comments on the attempted "tax swap"? Does the governor favor or oppose raising taxes in times like these? Raising the taxes on those Texans who can least afford it, is ok in his eyes. To bad those voters don't get notified by "Live" of the threats that come from this "conservative" government in Austin.

Fake News and click bait , that is what has become of "Live".

- Log in or register to post comments

PermalinkReally sad that Gov. Abbott also did not tell local governments not to reappraise property values to get more tax revenue. Every year for the last 12 years, our home has been reappraised. Our tax rates are capped due to age and diasbility. But that doesnt stop the city from increasing the value of our little piece of property. We have protested every year but no one else in our neighborhood does so we have lost every time.

- Log in or register to post comments

PermalinkPost a comment to this article here: