WASHINGTON – President Biden signed the 'Inflation Reduction Act' into law Tuesday increasing taxes to spend on Climate Change and expanding the IRS. The measure doesn't reduce inflation.

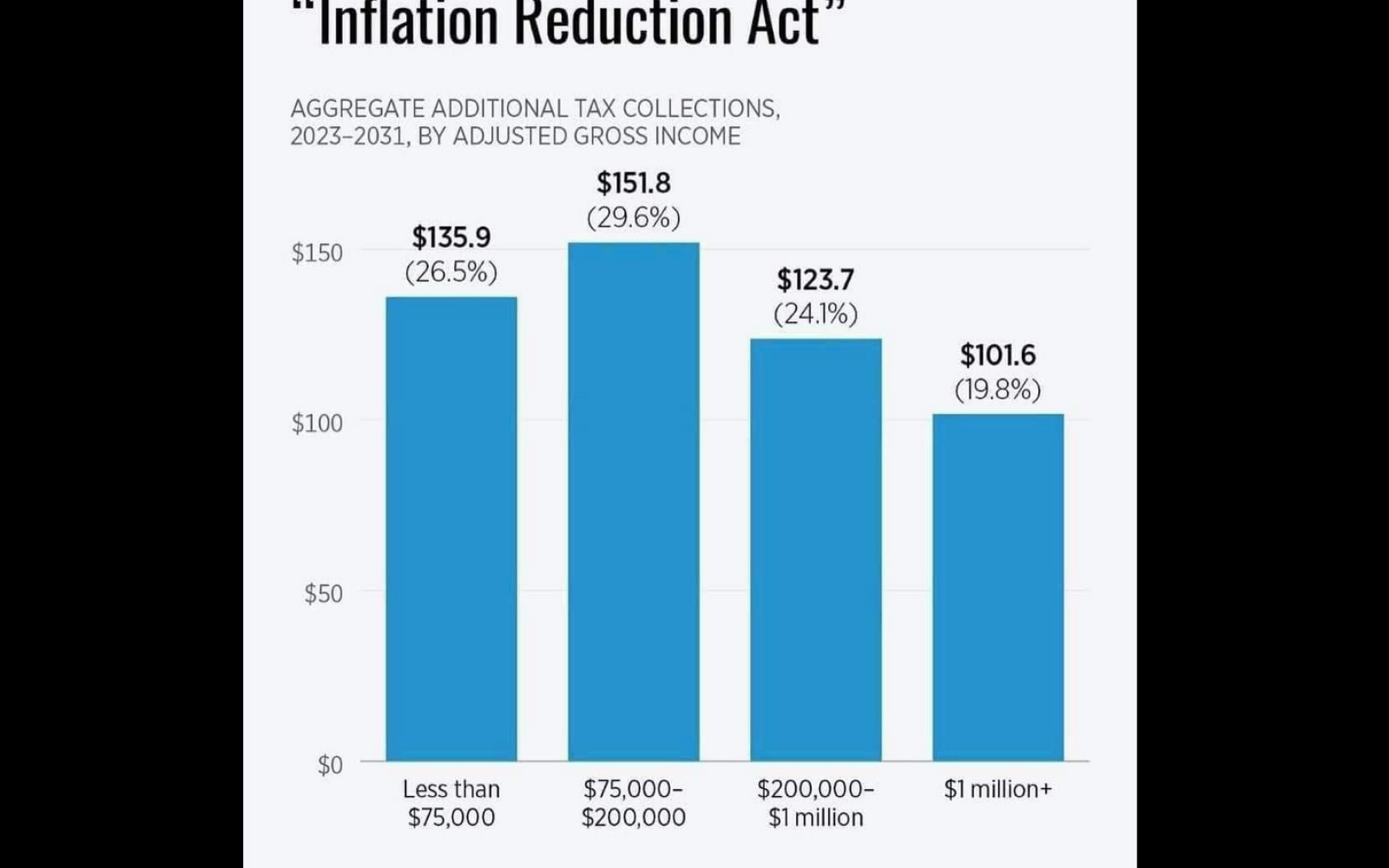

Fox News is reporting the bill, which was passed by the Senate earlier this month and the House of Representatives last week, costs an estimated $437 billion, with $369 billion going toward 'investments' in "Energy Security and Climate Change," according to a summary by Senate Democrats. Translation: it's a tax increase.

Democrats project that the legislation will reduce the deficit by bringing in $737 billion. This includes an estimated $124 billion from IRS tax enforcement, the projected result of hiring 87,000 new IRS agents who will ramp up audits.

The bill also imposes a 15% corporate minimum tax that the Joint Committee on Taxation predicts will raise $222 billion, and prescription drug pricing reform that the Senate estimates will bring in $265 billion.

The Congressional Budget Office said the bill will have "a negligible effect" on inflation in 2022, and in 2023 its impact would range between reducing inflation by 0.1% and increasing it by 0.1%. It will not, in fact, reduce Biden's inflation.

The IRA bill passed both houses of Congress along party lines. No Republicans in the House or the Senate voted for the measure.

The United States is facing record-high levels of inflation, which slowed in July for the first time in months but kept prices near the highest level in 40 years.

The Labor Department said last week that the consumer price index, a broad measure of the price for everyday goods, including gasoline, groceries and rents, rose 8.5% in July from a year ago, below the 9.1% year-over-year surge recorded in June. Prices were unchanged in the one-month period from June.

Scorching-hot inflation, as Fox News reports, has created severe financial pressures for most U.S. households, which are forced to pay more for everyday necessities like food and rent. The burden is disproportionately borne by low-income Americans, whose already stretched paychecks are heavily impacted by price fluctuations.

Vice President Kamala Harris cast a tie-breaking vote to allow the legislation to pass, 51-50, in the Senate, and the House passed the legislation a few days later.

Joe Biden & Robert O'Rourke (Contributed/google images)

Biden Signs IRA Act Tax Increase Wealth Transfer Law (Contributed/Heritage Foundation)

Subscribe to the LIVE! Daily

Required

Comments

Why do we need an inflation reduction act if they say it’s now 0%? I also remember certain news stations last year saying inflation was actually good and hurt the rich?

- Log in or register to post comments

PermalinkPost a comment to this article here: