SAN ANGELO – Tom Green County Commissioners Tuesday are set to finalize the annual process of adopting a budget and tax rate during their regular meeting that will decrease the tax rate but increase revenue in the midst of 9.1% inflation, skyrocketing fuel & electricity prices and the struggle to hire and keep employees.

After weeks of budget hearings where dozens of department heads and elected officials made their case for pay raises amid runaway inflation and economic uncertainty, commissioners hammered out a proposed budget that will provide a pay raise for employees of 5% and provide the necessities for the county to perform its Constitutional duties.

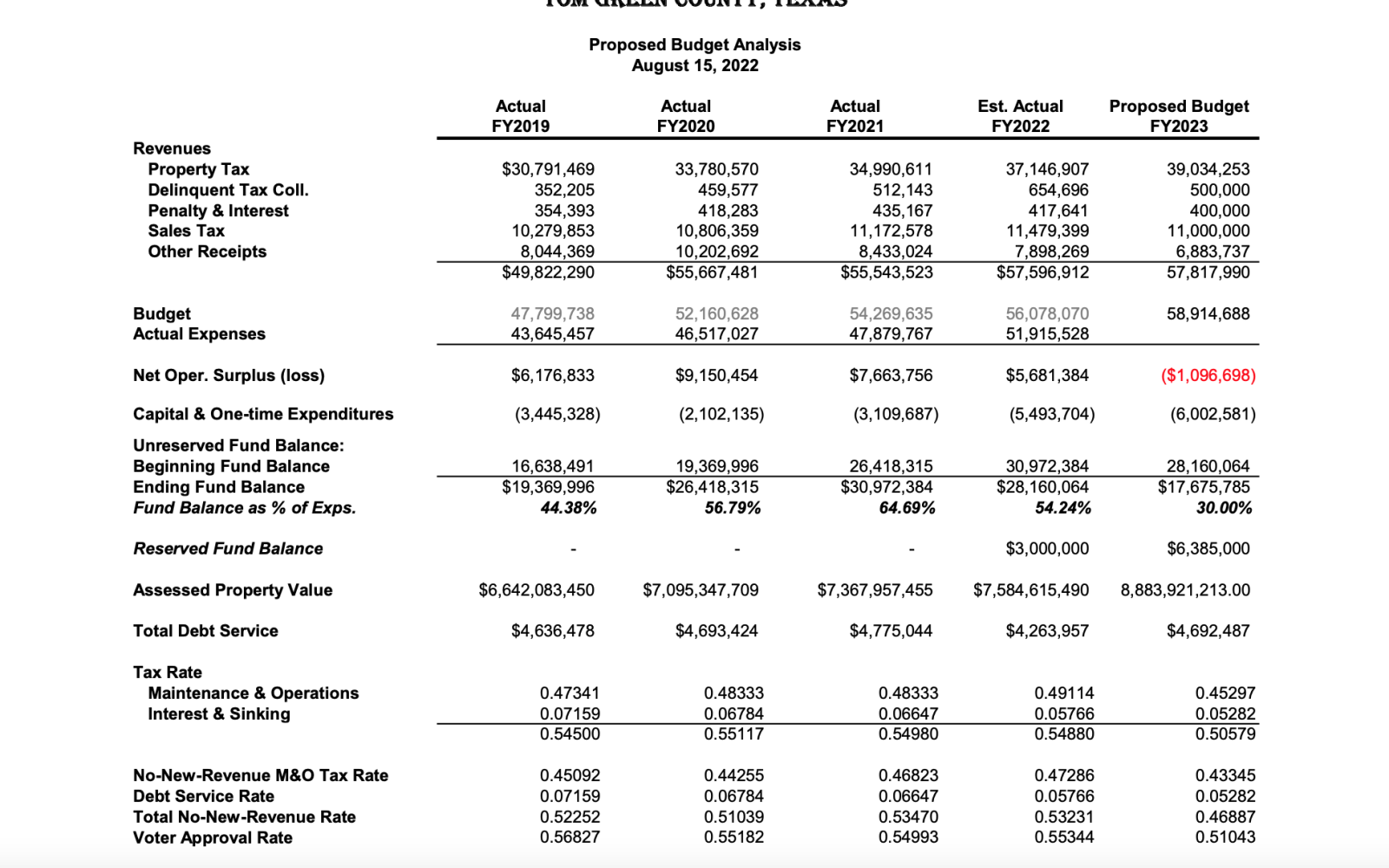

The current tax rate for Tom Green County is .54880 cents per $100 dollars in property value. The proposed tax rate is .50579.

The required language for the proposed budget is as follows: "This budget will raise more total property taxes than last year's budget by $3,530,679 or 8.46%, and of that amount $844,410 is tax revenue to be raised from new property added to the tax roll this year."

The Texas Legislature has developed a specific order in which Texas Counties can adopt a budget and tax rate.

In a process that only makes sense to lawyers and law makers, Texas counties have a very narrow window set a tax rate. For Tom Green County, that window is between a no-new-revenue tax rate of .46887 cents per $100 in property value and a voter approval rate of .51043. The proposed rate is .50579.

Here is the legal process the Commissioners Court will follow Tuesday:

- Recess the Court's Open Session

- Convene a Public Hearing and take public comment on the proposed budget

- Adjourn the Public Hearing

- Consider changes to the FY2023 budget

- Adopt the FY2023 budget and take a record vote

- Consider ratifying the property tax increase reflected in the FY2023 budget

- Adopt the FY2023 Tax Rate and take a record vote

The Commissioners Court Hearing is open to the public and begins at 8:30 a.m. Tuesday morning, Sept. 6, 2022 in the Commissioners Court Meeting Room on the second floor of the Keyes Building.

Tom Green County FY2023 Proposed Budget (Contributed/TGC)

Subscribe to the LIVE! Daily

Required

Post a comment to this article here: